“Explore the latest trends and tips for buying repossessed houses in Manchester. Find out what makes 2024 a unique year for grabbing a property bargain in this vibrant city.”

Find out in this 2024 guide, “How to Buy Repossessed Houses in Manchester”. We reveal trends, legal advice, and practical steps for securing investment in a growing, vibrant market. The Manchester property market is booming – and repossessed property is no exception. Repossessed houses are usually priced below the market value, thus serving as desirable options for investors and homebuyers.

Repossessed properties are houses taken back by lenders for lack of mortgage payment. Hence, repossessed homes are sold, and the primary point of sale is auctioned to recoup the outstanding arrears. By their nature, these sales often mean the price paid is less than the going rate in the general market.

Repossessed properties are increasingly hitting the limelight in the housing market in Manchester. www.gov.uk shows that most of the surge in repossessed properties is likely due to economic changes and fluctuating interest rates. This increment represents an increase in opportunity for potential buyers who can invest or look at another home at a lower price.

In 2023, the North West of England revealed 697 repossessed property deals as part of the public picture, out of the total 3475 sold across England. This makes the North West one of the more significant areas for repossession deals, compared to London, with 450 deals. This data shows an elevated degree of repossession action in the North West, compared with regions such as the East of Britain and the South East, which have much lower figures.

Manchester continues to take pride in being at the forefront with the first-time buyer market bursting. Still, it also benefits from the long-term investors drawn to the ongoing development and regeneration projects.

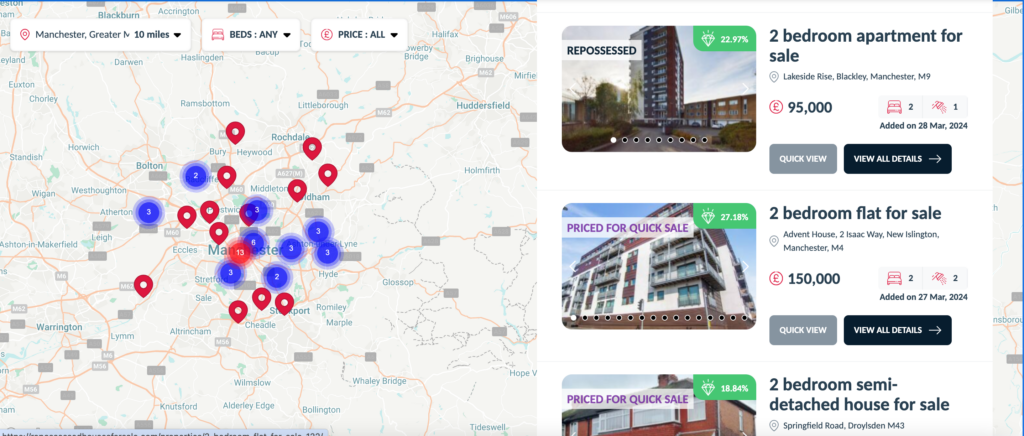

Manchester is becoming one of the fastest-growing cities in the UK and offers immense investment opportunities. With the city growing and its rejuvenation initiatives drawing many buyers, it’s worth taking note of the repossessed houses that are entering the market.

If you’re considering buying a repossessed house in Manchester in 2024, places undergoing extensive development are a good bet. Ancoats has recently transformed a lot, becoming quite trendy, which can increase property prices. Salford is another area to watch, mainly because it’s close to the media city and has a growing tech scene.

Plus, any areas expected to benefit from new transport links, like Metrolink expansions, could also be smart picks. Look at the local crime rate and schools, which can affect a property’s long-term worth.

The most common way of buying a repossessed property in Manchester includes the following key stages:

Buying a repossessed property can introduce difficulties, such as property damage, disputes attached to the property, and contests at the auction. Work through these by remaining adaptable in your decisions, keeping a budget cushion for unforeseen costs, and staying informed about legitimate and monetary viewpoints connected with your purchase.

In Manchester, successful buyers in the repossessed property market often engage in thorough due diligence and understand local market trends, which enables them to purchase properties at competitive prices and often with significant equity.

The legal part of buying repossessed properties can get messy, with issues like debt or, worse, an ownership dispute. Legal professionals such as TMFortis Solicitors can extend their advice and take legal action upon necessity. Expert knowledge is always advisable.

Repossessed houses in Manchester offer a suitable pathway to property possession and significant monetary advantages. The cycle requires fastidious thought, ideal readiness, and a proactive approach to exploring potential difficulties. With the right system and direction, you can explore Manchester’s property market for valuable investments or find a new home reasonably priced.

What is a repossessed property? The mortgage company reclaimed the property because the homeowner defaulted on their payments.

Are repossessed properties less expensive? Indeed, they are typically sold at lower costs than comparable properties on the open market, offering more reasonable open doors.

How can I track down repossessed properties in Manchester? Use online property sites, contact estate agents or auction houses, and check for houses in repossession.

What should I know when considering purchasing a repossessed property? You should know about expected legal issues, the state of the property, and any financial commitments attached to it.

Could I view a repossessed property before it goes up for sale? Indeed, it is strongly advised that you evaluate the condition and state of the property in advance.

48-hour FREE trial, then

12 months for the price of 7, billed annually.

48-hour FREE trial, then

Monthly rolling – no contract