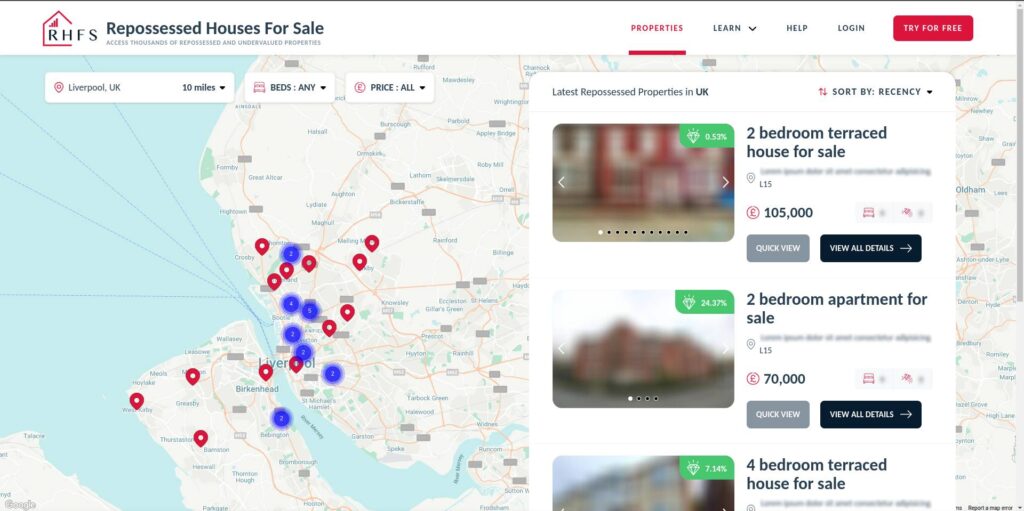

Access thousands of repossessed and undervalued properties

L5

L5

L8

L8

Liverpool

Liverpool

Liverpool

Liverpool

Liverpool

Liverpool

L8

L8

L6

L6

L1

L1

L5

L5

Bootle

Bootle

L25

L25

L1

L1

L18

L18

Liverpool

Liverpool

Street

Street

L14

L14

L13

L13

L6

L6

L6

L6

L11

L11

L36

L36

L6

L6

L6

L6

L13

L13

L6

L6

L3

L3

L3

L3

Liverpool

Liverpool

5BE

5BE

Bootle

Bootle

L4

L4

L20

L20

Liverpool

Liverpool

L7

L7

L13

L13

L13

L13

Fazakerely

Fazakerely

Fazakerley

Fazakerley

Liverpool

Liverpool

L25

L25

L14

L14

L12

L12

L36

L36

L36

L36

L6

L6

L3

L3

Liverpool

Liverpool

L36

L36

Liverpool

Liverpool

L25

L25

L6

L6

Liverpool

Liverpool

L1

L1

L10

L10

L13

L13

L4

L4

Liverpool

Liverpool

3BG

3BG

L4

L4

L6

L6

L6

L6

L6

L6

Liverpool

Liverpool

L9

L9

Liverpool

Liverpool

Liverpool

Liverpool

Bootle

Bootle

Bootle

Bootle

Liverpool

Liverpool

L6

L6

L17

L17

L17

L17

L15

L15

L13

L13

Liverpool

Liverpool

Liverpool

Liverpool

L4

L4

L20

L20

L6

L6

L5

L5

L3

L3

Gardens

Gardens

L3

L3

L5

L5

L2

L2

Liverpool

Liverpool

Wavertree

Wavertree

L11

L11

Bootle

Bootle

L20

L20

Liverpool’s affordability in comparison to other key Northern regional growth areas sets it apart from other cities. With high yields and consistent capital growth, Liverpool exemplifies some of the very best opportunities for repossessed property investment.

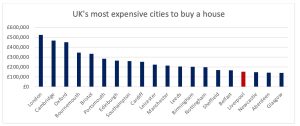

Recent research from Zoopla, which looks at the top 20 cities in the UK, shows that Liverpool is the 4th least expensive city in the UK with an average sold price of £152,300, only Newcastle, Aberdeen and Glasgow boast a lower figure. Being able to pick up properties at up to 30% below market value, Liverpool provides a fantastic opportunity for those seeking properties at low cost with high levels of value.

Liverpool is an incredibly vibrant city and its appeal to tenants, buyers and investors continues to grow by the day. This has been spurred on by the Northern Powerhouse initiative, a plan which will continue to drive demand for property in Liverpool for the foreseeable future.

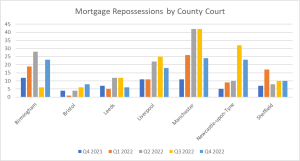

Using the latest gov.uk data we know that the North West region has the second highest number of repossessed houses when compared to other UK regions, with a total of 502 which accounts for 18% of all repossessed properties in the UK.

When looking at Liverpool itself, we can see that the city recorded 76 mortgage repossessions across 2022. The latest Q4 (Oct-Dec) shows a decrease of 28% when compared to the previous quarter. However, when compared to the same quarter in the previous year, Liverpool recorded a large increase of 64% YOY.

Finding Repossessed houses in Liverpool is extremely easy. Subscribers can simply search for Liverpool, or a specific area in Liverpool, and our platform will provide all the relevant repossessed properties.

As 2022 came to a close, one of the most exciting locations for property investors in the UK received more positive news, positioning it in an excellent place for the new year.

In their latest City Livability Index, Liverpool has been voted the best place to live and work in the UK by the financial services provider OneFamily.

This saw Liverpool rise up the Index from 4th place (where it finished in 2021) to the top position, a reflection of the high level of satisfaction Liverpudlians have with their city and the thriving prospects 2023 brings.

Liverpool ranked highly across the board for key factors such as a manageable cost of living, the pace of life, the happiness of citizens and pride in the city.

In terms of what this means for the repossession market, we predict that Liverpool will be one of the most sought-after areas for investors looking at repossessed houses in the UK. New property listings have declined in this area which could result in high demand for high value repossessions in the city. In the North West, the property pipeline has seen a -57% reduction, climbing to -64% in Liverpool specifically.

Now is the perfect time to invest in Liverpool and there is no better way than to enter below market value with a repossessed property. Our sourcing team continually uncovers Liverpool’s highly desirable repossessed properties, providing our clients with exclusive access to some of the most highly sought-after repossession investment opportunities in the country. subscribe today to have a look at our regularly updated database of repossessed properties in Liverpool.

Repossessedhousesforsale.com is a market leading repossessed property sourcing agency that has revolutionised the way investors access exclusive below market value investment opportunities.

With a limited time offer ends in August

48-hour Free Trial, then

48-hour Free Trial, then