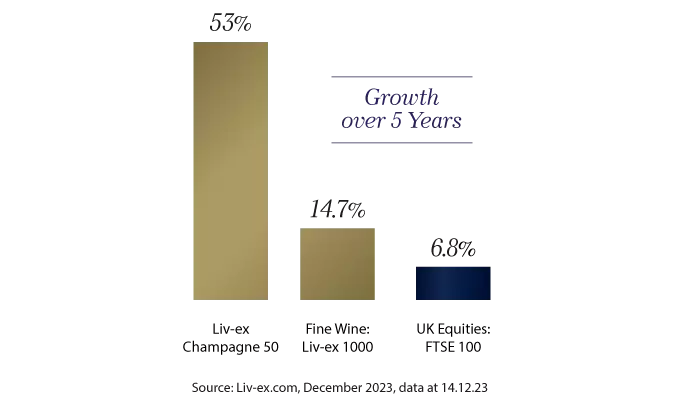

Our partner Vin-X, is offering a special offer to invest in fine wine; a stable, tax efficient asset which is resiliant during periods of economic stress, and delivers strong long-term growth, proven to outperform traditional investments.

Vin-X are offering 5% off your first investment!